Class Action Solutions

We develop custom solutions and proven strategies to help our clients prevent, manage or effectively reduce all types of employee based class action liability focusing on wage & hour collective actions. With over a 120 years of combined legal and Department of Labor experience, our team excels at creating effective solutions many of which provide an immediate ROI on present & future class action liability. Contact us today and discover the solutions we can create for you. Request a Free ConsultationWho We Are & What We Do:

Over the years, our leadership team and senior advisors have successfully collaborated on hundreds of wage & hour class actions, saving employers hundreds of millions of dollars. With Class Action Solutions (“CAS”), we have created a company dedicated to developing innovative and custom solutions to prevent, eliminate and/or manage businesses’ exposure to class/collective actions under the Fair Labor Standards Act (“FLSA”) governing, among other things, the payment of employee wages and overtime. To be clear, our solutions are equally effective on most employee based class actions unless prohibited by law.

- Leadership: At its core, CAS is comprised of 1) senior management-side labor & employment attorneys with significant expertise in defending wage-based (and other types of employee based) class/collective actions and 2) former Wage & Hour Division heads from the Department of Labor (“DOL”) who frequently collaborated to resolve complicated wage & hour problems for companies of all sizes and in every industry.

- Expertise & Innovation Re: Wage and Hour Collective Actions. CAS’ founders have comprehensive client rosters covering every industry, ranging from mom & pops operations to multi-national Fortune 500 companies and everything in between. As the wage & hour collective/class action problem grew to national epidemic proportions, CAS’ founders’ respective practices became proportionally focused on innovating custom solutions to this growing plague. In response to the ever-growing demand, CAS was created to be a bastion where businesses can find legal and regulatory experts exclusively dedicated to developing bespoke solutions to the problems arising from the plague of employee based collective/class actions. Collectively, CAS professionals have over 120 years of experience developing innovative solutions that either prevent or successfully resolve collective/class actions in 1) federal and state courts; 2) before the Wage & Hour Division of the DOL; 3) as analogous state agencies; and 4) arbitration. Further, CAS’ custom solutions are based on proven legal and administrative practices which are both cost effective as demonstrated by reliable return on investments (“ROI”).

Our Services

Need A Consultation?

Are you currently defending an employee based class action? Do your employees frequently make claims for unpaid wages such as overtime and bonuses? Do you outsource payroll and/or your HR function? Do you believe that outsourcing these obligations absolves you of legal liability if violations occur? Do you believe you have insurance coverage for wage and hour lawsuits including class actions? Are you confident that you know and are compliant with your obligations under the myriad of federal, state and municipal labor, employment and wage and hour laws? Why find out the hard way? Schedule a free consultation today with one of our experts to learn if you have any exposure to employee based Class Action liability, and if so, the potential solutions to protect yourself.

THE PROBLEM: FEDERAL WAGE & HOUR COLLECTIVE ACTIONS

Collective Actions: Where wage & hour liability is made manifest. Typically, wage & hour violations manifest as permissive class/collective actions which are inherently punitive to employers by design and structure. The more significant punitive aspects of collective actions follow:

- Legalized Extortion: Typically, the class certification stage is designed to be very challenging regarding both evidentiary and financial requirements. As such, the normal class certification system filters out fraudulent claims as well as those that have little or no merit. In contrast, the conditional class certification process creates a de facto system of legal extortion that victimizes employers. As the class is “conditionally” certified, the employer must hemorrhage defense costs (e.g., the legal fees that the employer pays its own attorney) immediately in an effort to prove that conditional certification status is meritless. The defense costs associated with defeating conditional certification range from hundreds of thousands of dollars on the low end to tens of millions of dollars on the high end. Upon conditional certification[1], the employer’s defense costs become a fixed expenditure, and the plaintiffs’ counsel regularly attempts to force settlement that equals the employer’s defense costs minus a discount. As the employer knows that it will have to pay plaintiff’s attorneys fees if the plaintiff wins one cent, it usually makes the business decision to settle. Unfortunately, this process is repeated at nauseum with putative class members who were not covered by the initial settlement agreement.

- Permissive Class Certification: A “conditional” class certification process only requires two current (or former) employees to file short-form affidavits simply alleging wage violations. Once the affidavits are filed, the courts are statutorily obligated to grant “conditional” certification. Accordingly, the court system is clogged with frivolous collective actions; and yet, countless new collective actions of questionable merit are filed every day.

- Notice to All Putative Class Members & Related Categories of Liability: Upon the granting of conditional certification, a court sanctioned notice is sent to all putative class members apprising them of their respective rights either to join the pending collective action or to file their own action with the court or Department of Labor (“DOL”). It is helpful to organize these putative class members into three distinct categories of liability:

- Present Liability: Present Liability is created when current employees suffer wage violations as well as future employees if such wage violations are not corrected;

- Residual Liability: Residual Liability is created by former employees who allege wage violations during the five-year statute of limitations; and/or

- Hidden Liability: Hidden liability is created by independent contractors (and misclassified employees) who claim wage violations based on allegations that they are misclassified employees. Note: Independent Contractors may receive notice only upon separate determination by the court that plausible evidence may exist to prove the misclassification of employees as independent contractors.

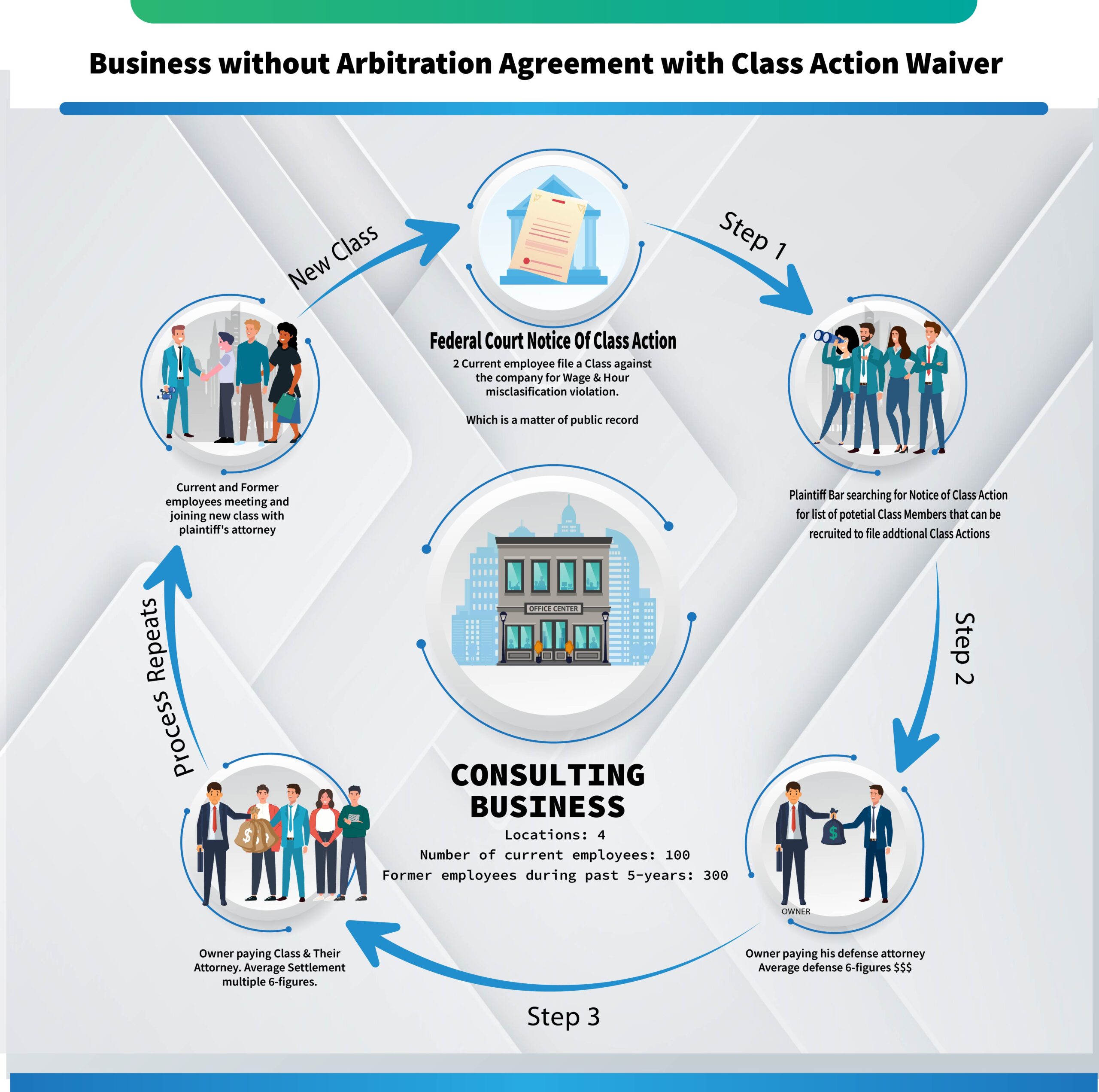

- A Single Violation Can Be the Catalyst for a Chronic Cycle of Collective Actions: When viewed as a whole, all collective actions are public records containing the contact information of countless putative plaintiffs who can file their own collective actions provided that the statute of limitations has not expired. This results from the limitless notices created in conjunction with the filing of each new collective action. Typically, the vast majority of putative class members receiving notice never join the pending collective action or file one on their own behalf. The plaintiff’s bar exploits these public records to recruit putative class members to file hundreds of thousands of new collective actions each year. See Exhibit “A” attached hereto:

- Damages: Plaintiffs may recover:

- Actual damages;

- Treble damages; and

- Attorney’s fees even if the plaintiff is awarded only ONE penny in back wages (Plaintiffs’ attorneys fees in a small collective action (e., a class of ten or less current/former employees) can easily exceed $500,000.00)

Note: As plaintiffs’ attorneys know that the employer will be ordered to pay their fees should their client be awarded one cent of back wages, they have no incentive to settle except on very favorable terms.

- Statutes of Limitations: Federal and State statutes of limitations combined start from the date of the last violation and may continue from five to seven years;

- Even When the Employer Wins, It Still Loses: Even if the employer wins the collective action, it will likely suffer significant financial harm resulting from cost associated with the mounting of a vigorous legal defense.

MISCELLANEOUS LABOR & EMPLOYMENT LIABILITY: Every business is beset by labor and employment liability which may manifest as legal action at any moment. Exposure to such liabilities can never be completely eliminated but it can be effectively reduced, contained and managed resulting in low-risk exposure maximizing the business’ value. The solutions identified herein not only address wage & hour liability but also every form of labor and employment liability uncovered by our recommended audits. Ultimately, any significant labor and employment liability will be uncovered during the sale due diligence process. Therefore, we recommend that the Company resolve these issues proactively. The types of labor and employment liabilities usually revealed by our audits include without limitation:

- PEO Liability Issues;

- Labor Relations Issues;

- Employee Handbook Issues;

- On-boarding Process Issues;

- Family Medical Leave Act Issues;

- Employee Benefits Issues;

- Discrimination Issues;

- Covid-I9 Compliance Issues;

- Workers’ Compensation Issues;

- Various Issues related to Pandemic Laws; and

- Employment Tax Issues.

[1] Conditional certification is typically granted in the first two months of the action.

SOLUTIONS: ELIMINATING, REDUCING & CONTAINING CLASS ACTION LIABILITY.

- Audits Regarding Present Liability: These audits will cover:

- All current employees who may expose the Company to Present Liability;

- These audits will simultaneously cover the Company’s exposure to miscellaneous labor and employment liability.

- Present Liability Solution – Voluntary Compliance with Immediate Payment of Back Wages: If Present Liability is revealed by the audit, we recommend voluntary payment of back wages to the affected employees. If fact, the law requires payment of back wages. We have proven solutions that ensure back wages are paid while simultaneously obtaining protections from legal action by aggrieved employees. Features of our Present Liability Solutions include:

- One-on-one meetings with each aggrieved employee for purposes of:

- Explaining that the payment error was revealed during a routine audit, and the Company took this action to immediately correct it;

- Evaluate the litigious capacity of each aggrieved employee and take appropriate measures to ensure that any potential for adverse legal or administrative action is contained.

- Obtaining admissible affidavits that affirm:

- The only wage violation that employee has suffered is the one the Company brought to his/her attention; and

- Upon payment of back wages, employee affirms that he/she has suffered no other wage violation.

- Built-in Compliance and Oversight: Part of our Present Liability Solution includes implementation of best practices that if followed, will prevent future Present Liability and related violations.

- One-on-one meetings with each aggrieved employee for purposes of:

- Audits Regarding Residual and Hidden Liability: These audits will cover:

- All former employees who expose the Company to Residual Liability during the relevant statute of limitations period(s).

- All current independent contractors who may be misclassified.

- All current employees who may be misclassified.

- Audit of miscellaneous labor and employment liability will be conducted simultaneously.

- Residual Liability Solution – Voluntary Compliance “Partnership” with DOL: If Residual Liability is revealed by the audit, we will recommend voluntary payment of back wages to the affected former employee. If fact, the law requires payment of back wages. We have proven solutions that ensure back wages are paid while simultaneously obtaining protections from legal action by aggrieved former employees. If the Company owes back wages, we recommend that we voluntarily involve the DOL in the back wage payment efforts and request that DOL issue the Company WH-58 Waivers barring the aggrieved former employees from future legal action regarding this issue. NOTE: We cannot guarantee that the DOL will issue WH-58 waivers but to date, we have had a 100% success rate. Our success in this regard is due to the great respect Jorge Rivero has at the DOL as a former Division Chief of the Wage & Hour Section.

- Alternate Residual Liability Solutions: Payment of back wages can be accomplished without the involvement of the DOL but it is a much more complicated process and depending on individual circumstances, may pose a greater threat of adverse legal action by the affected former employees. While we cannot make any guarantees, we currently have a 100% success rate of conducting non-DOL voluntary back-wage payments without triggering any adverse legal action.

- Built-in Compliance and Oversight: Part of our back wage solution includes implementation of best practices that if followed, will prevent future wage violations and related back wage payments.

- Class/Collective Action Solution For Current Independent Contractors & Those Subject To W-2 Conversion: Implementation of New Independent Contractor Agreements & Related Documents:

To reduce and contain exposure to Hidden Liability created by independent contractors, misclassified employees and/or other problems, we recommend that such problems be corrected immediately. As for independent contractors, we typically recommend the implementation of our proprietary independent contractor agreements and related documents.

- Our propriety independent contractor agreements and related documents feature:

- Class Action Waivers;

- Self-actuating terms that prevent or significantly reduce the potential for misclassification;

- Self-actuating terms that prevent independent contractors and their employees from engaging in conduct that may create misclassification determinations;

- Self-actuating terms that require mandatory oversight by independent contractor management to ensure compliance with all material terms including “misclassification provisions” designed to reduce and contain Hidden Liability;

- Terms that provide employers (or their designees) the right to audit the independent contractor compliance with all material terms with remedy provisions for non-compliance; and

- Admissible Affidavit(s) that can be used in defense of:

- Administrative and legal misclassification actions;

- Wage & Hour collective actions; and

- Administrative and legal actions for any type of Wage & Hour violation.

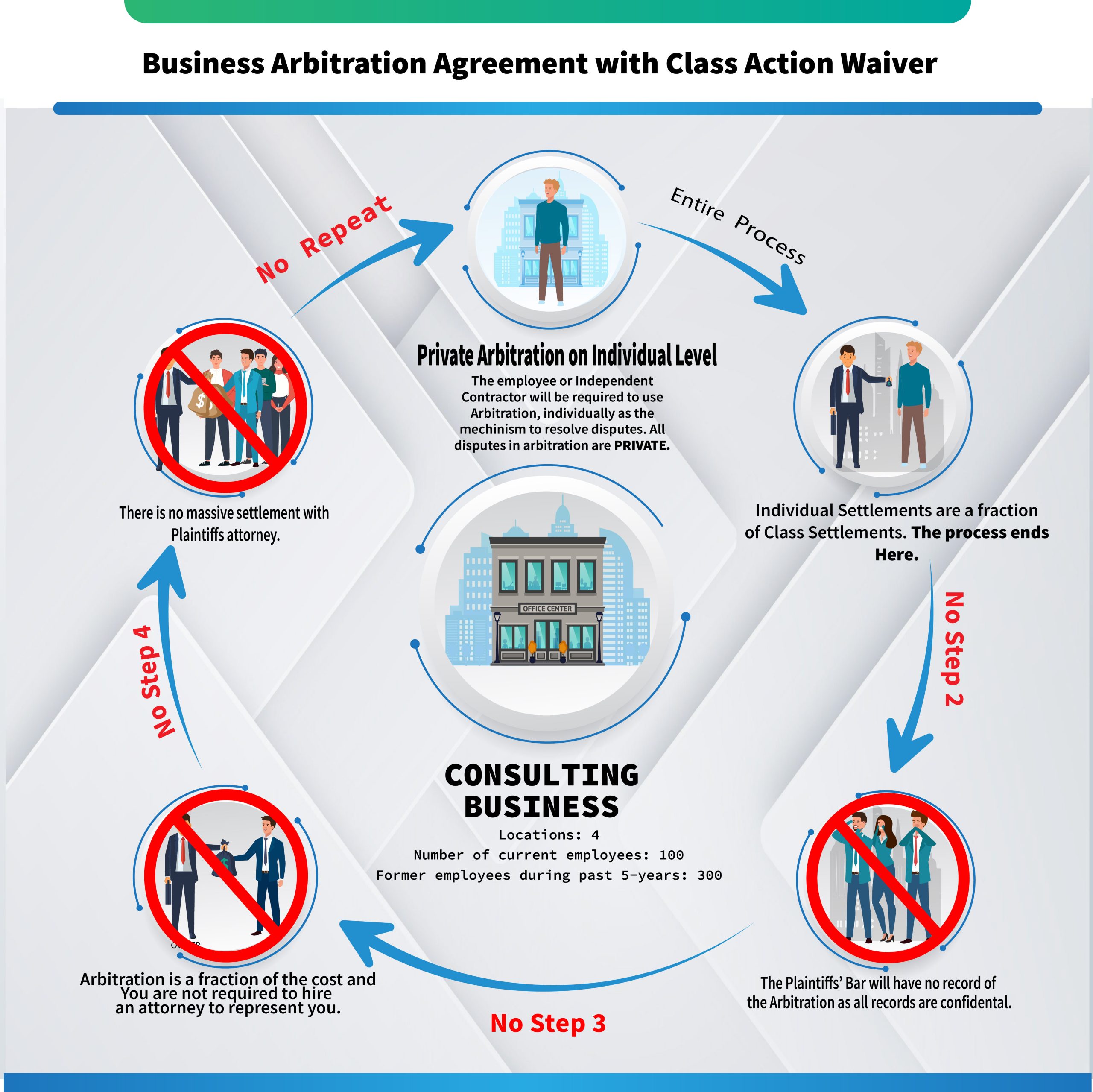

- Class/Collective Action Solution: Implementation of a Company-Wide Mandatory Arbitration Program with a Class Action Waiver: If executed correctly, this solution can literally eliminate all Present Liability collective actions as well as any other type of class/collective actions covered by the arbitration agreement. For your edification, we answer the following questions:

- What is Arbitration? Arbitration is a private court system that

- Costs less than traditional court;

- Resolves disputes much faster than traditional court; and

- Lawyers are not required to arbitrate a dispute; and

- All arbitrations including their related documents, testimony, etc. are private, confidential and not subject to public record laws.

- What is a Class Action Waiver? A class action waiver is a contractual provision often found in arbitration agreements that prevent parties to the agreement (the Company’s employees and independent contractors in this situation) from seeking class or collective relief for any dispute that they have with the Company.

- Custom Solutions: There are many types of arbitration agreements and/or alternate dispute resolution programs and we create a custom arbitration solution that best fits each client’s unique goals and needs. By way of example, our proprietary arbitration solutions often contain the following features:

- A mandatory condition of employment for all current and future employees;

- A mandatory condition of engagement for all current and future independent contractors;

- Class action waivers;

- Employer paid filing fees;

- Mandatory compliance with select Federal Rules of Procedure regarding discovery and summary judgment;

- Mandatory compliance with the Federal Rules of Evidence;

- Mandatory compliance with Federal Rules of Appellate Procedure;

- A right to arbitration appeal; and

- A provision providing that the express terms of the arbitration agreement supersede any conflict with the arbitration company’s arbitration rules and procedures.

- What is Arbitration? Arbitration is a private court system that

- Our Proprietary Arbitration Agreements, Class Action Waivers and Independent Contractor Agreements as Well as Their Related Implementation Processes Are Designed to Create a Bulwark of Admissible Evidence Against Legal Challenges: If not implemented correctly, any contract (including arbitration agreements, class action waivers and independent contractor agreements) may be rendered null and void by any ordinary contract defense (e.g., mistake, fraud, coercion, duress, etc.). Therefore, both the agreements and the processes by which they are implemented need to be carefully considered and executed. Our implementation processes anticipate legal challenges and are designed with countermeasures. Features of our implementation processes are set forth below:

- Satisfaction of all legal requirements for the Company’s specific legal jurisdiction(s).

- Video and biometric recordings of employees’ acceptance of the arbitration agreement.

- Redundancy of all requirements needed to prove acceptance/validity:

- Manual and electronic signatures.

- Arbitration agreements provided in training session, by email and at the HR Department where applicable.

- Development of on-boarding process for new employees that includes acceptance of arbitration agreement;

- Implementation process that captures “all” employees including those on leaves of absence;

- Creation of an arbitration program and related documents with corresponding modification of employee manual;

- Unified Message:

- Coordination with Upper Management and Human Resources;

- Single point of contact to address questions; and

- Scripts to respond to inquires that inevitably circumvent the “single point of contact” system.

- Employee Education and Familiarization:

- Frequently Asked Question Documentation;

- Documentation regarding “Arbitration: A Win-Win for Both Employers and Employees;”

- Arbitration Contact/Resource Documentation: Enabling employees to understand and use the Company’s new arbitration program;

- Questions and/or concerns hotline available during implementation phase and beyond; and

- Company specific videos on how the arbitration program works.

Note: While the law only requires that the arbitration materials be in English, we often create the materials in several languages at the clients request.

- Active Oversight Until the Client can Independently Operate our Solutions: As the containment and reduction of labor and employment liability is the client’s Primary Objective, we often recommend than Jorge Rivero and his team maintain oversight of the all labor and employment compliance until the client is capable of operating our solutions independently.

- A Resource Clients Selling their Business: We will be an active resource to client by providing the following services:

- Education of potential buyers regarding the methods implemented by the Company that eliminate, reduce and/or control labor and employment liability;

- Provide documentation and testimony in support of the labor and employment due diligence process to ensure that the due diligence reports accurately reflect all the methods implemented by the Company to eliminate, reduce and/or control labor and employment liability; and

Assist in the sales negotiations by being available to provide documentation and testimony countering any effort to discount the sales price based on the Company’s exposure to labor and employment liability

Leadership Team

Devand A. Sukhdeo, Esq. - Founder

Management-Side Labor & Employment Attorney

Mr. Sukhdeo’s established practice in labor and employment law has encompassed the representation of varied employers, ranging in size from small to international, in manufacturing, retail, media, healthcare, hospitality, transportation, food service, finance, construction, professional sports teams and insurance industries. For the last 20 years, the primary focus of his practice has been the defense of large employee-based class actions many of which having liability exposures over $200 million dollars. He regularly handles simple, complex, multiple party and class action litigation. His expertise includes extensive litigation in the areas of unfair competition, trade secret violations, employment discrimination, wage and hour violations, disability access disputes and employee benefit/ERISA disputes. Mr. Sukhdeo has also represented and advised employers concerning unfair labor practice investigations and proceedings, union representation elections, and CBA negotiations. Mr. Sukhdeo has gained vast experience in alternative dispute resolution and negotiation strategies through his work in these areas.

Apart from his litigation practice, Mr. Sukhdeo counsels employers on strategies for minimizing potential litigation and timely planning for the defense of unavoidable litigation. He regularly advises employers on day-to-day personnel matters and practices, with a keen understanding of the business and legal factors that must be weighed in making human resources decisions. Mr. Sukhdeo specifically assists employers in such matters as reductions in force (RIFs), plant closings, employee termination/discipline, applicant background checks, employee handbooks, workplace violence, and implementing effective personnel policies. He also provides in-house training on labor and employment law topics for both management and non-management employees. In addition, separation and severance agreements designed to protect employers from future litigation from former employees are an important aspect of his practice.

Mr. Sukhdeo obtained his BA from Columbia College in New York City and his JD from NYU School of Law. He is member of both the Florida Bar and the New York Bar and has been accepted to practice before the following federal courts: 11th Circuit Court of Appeals, the Southern District Court of Florida, the Middle District Court of Florida, the Northern District Court of Florida, the 2nd Circuit Court of Appeals, the Sothern District Court of New York and the Eastern District Court of New York.

Jorge J. Rivero - Founder

Former Director U.S. Department of Labor, Wage and Hour Division for South Florida.

Jorge J. Rivero began his career with the U.S. Department of Labor in 1978. During his career with the Department, he served as a Wage and Hour (WH) investigator, during which time he investigated thousands of allegations of Fair Labor Standards Act (FLSA) and other law violations. Additionally, he served as an Assistant District Director in which position, he reviewed the FLSA findings of investigators under his supervision, trained new investigators and assisted investigators in the completion of difficult FLSA investigations. He served as the District Director for South Florida between March 1991 and June 2004.

As District Director, Mr. Rivero was responsible for developing and directing the Division’s programs and operations in South Florida. This included the enforcement, compliance, education and information programs conducted under the statutory authority contained in the Fair Labor Standards Act, Family and Medical Leave Act, and others. In that period, he also reviewed all cases involving serious violations of the FLSA to determine the disposition of same, conferred with employers and/or their representatives regarding the investigation and application of the FLSA, back wage restitution, civil money penalties and proposed litigation.

Mr. Rivero was also a member of the Wage and Hour National and Regional Office teaching staff and was frequently called upon by both the Wage and Hour Regional and National offices to participate in various teams to formulate and implement national and regional enforcement strategies, to develop educational and training materials for both their enforcement staff and the public and to conduct training for new Technicians and Investigators and for WH managers.

Mr. Rivero is currently an independent Federal Labor Law Consultant providing expert witness and FLSA compliance consultation services (including compliance audits) to both attorneys and employers. He is also past President of the South Florida Compensation and Benefits Association, an affiliate of the World at Work Organization.

Mr. Rivero currently serves on the Board of Directors of the Florida Restaurant and Lodging Association.